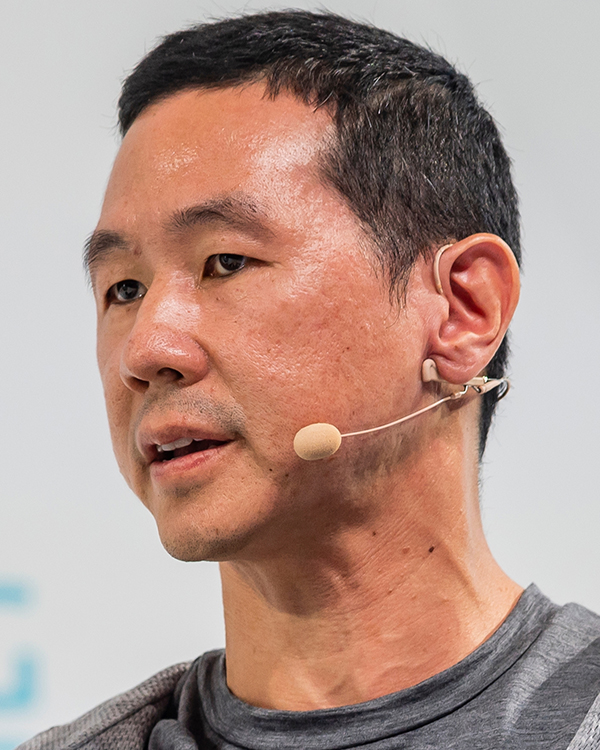

Keynote Speaker

Hong Kong Exchanges and Clearing Limited

Nicolas Aguzin joined HKEX as Chief Executive Officer on 24 May 2021 from J.P. Morgan, where he was most recently Chief Executive Officer of J.P. Morgan’s International Private Bank. Mr. Aguzin has been based in Hong Kong since 2012.

From 2013 to 2020, Mr. Aguzin was CEO, J.P. Morgan, Asia Pacific where he was responsible for all the firm’s business across 17 markets. Mr. Aguzin presided over some of the firm’s major expansion efforts during the period, including establishing itself in China as one of the few international financial institutions with a full range of services and capabilities; including a fully-owned locally incorporated commercial bank, a majority-owned securities company, an asset management company and a futures and options company. Concurrent with his Asia CEO role, Mr. Aguzin also ran J.P. Morgan’s Investment Banking division in Asia. During his tenure the bank rose to become one of the leading investment banks in the Asia Pacific region.

Mr. Aguzin joined J.P. Morgan in 1990 in Buenos Aires as a financial analyst. Between 1990 and 2005, he held a variety of roles in New York and Buenos Aires, and in 2005 he was appointed as CEO, Latin America. In 2008 and 2009, in addition to his responsibilities as CEO, Latin America and Head of Latin America Investment Banking, he served as Senior Country Officer for Brazil.

Mr. Aguzin holds a bachelor degree in Economics from the Wharton School of the University of Pennsylvania in the US and is fluent in Spanish, Portuguese and English.

Speakers

(Speakers are listed in alphabetical order of their last name)

The Hongkong and Shanghai Banking Corporation Limited

Sami Abouzahr is Head of Investments and Wealth Solutions Hong Kong for HSBC Wealth and Personal Banking in Hong Kong. He oversees HSBC Wealth and Personal Banking’s investments, insurance, FX and deposits businesses across mass, affluent and high net worth segments.

Sami has worked in a number of executive roles across HSBC, in London, Hong Kong and Shanghai. In his previous roles, he was Global Head of Wealth Solutions and Global Head of Wealth Sales Deployment. Prior to that he was a senior equity analyst and product specialist in HSBC Global Asset Management, before which he managed regional financial institution relationships for HSBC Global Banking. Sami holds an MSc in International Management, a BA in History, and is a Chartered Financial Analyst.

Animoca Brands Limited

Mr. Evan Auyang is the Group President of Animoca Brands, a Hong Kong-based multinational blockchain technology and investment company focused on developing the digital property rights ecosystem, including play-to-earn games, non-fungible tokens (NFTs), decentralized finance (DeFi), blockchain marketplaces, infrastructure and more.

Mr. Auyang is the Chairman of the Board of Civic Exchange. He serves as an Independent Non-Executive Director on three boards: the Urban Renewal Authority, Sun Hung Kai & Co. Ltd., and Asia Financial Holdings Limited. He is an Advisor for Our Hong Kong Foundation, and serves on the Innovation and Technology Advisory Committee of the Hong Kong Trade Development Council, the Transport Policy Committee of the Chartered Institute of Logistics and Transport, the Development Fund Committee of the Hong Kong Council of Social Service, the Advisory Council for Institute at Brown for Environment and Society for Brown University, as well as the Board of Advisors of Hong Kong 2050 is Now. In addition, Mr. Auyang is a lecturer at the Hong Kong Academy of Politics and Public Policy.

Prior to joining Animoca Brands, Mr. Auyang was the Managing Director and Head of GLG International (Gerson Lehrman Group). Before GLG, Mr. Auyang was the Deputy Managing Director of the Kowloon Motor Bus Co. (1933) Ltd. (“KMB”) and a board director of Transport International Holdings Limited. Prior to joining Transport International and KMB, Mr. Auyang was an Associate Partner at McKinsey & Company.

He obtained his undergraduate degree from Brown University and his MBA degree from the Kellogg School of Management.

Head of Sales, Wholesale Business, HSBC Global Asset Management (Hong Kong) Limited

Alison joined the finance industry in London in the 1980s and since then her career has spanned regional and country roles in strategy, marketing, product and sales management. In her current role at HSBC Global Asset Management, she is responsible for formulating strategic sales plans and driving business growth across retail and private bank segments in Hong Kong and China (offshore) by leading the sales and client servicing team.

Having been based in Asia since 2003, Alison has extensive Asian Wealth Management experience working for banks, asset management and insurance companies, joining HSBC Global Asset Management in 2015.

Alison has been on the HKIFA Executive Committee since 2020 and prior, as a member of the Unit Trust sub-committee with a view to fostering the development of Hong Kong’s fund investment industry.

As her original career was as a secondary school teacher, she holds a Bachelor of Arts and Diploma of Education later studying for a Graduate Diploma in Applied Finance and Investment, and an EMBA from the Australian Graduate School of Management.

Head of Compliance, Asia Pacific, Natixis Investment Managers

Florence is the Head of Compliance, Asia Pacific of Natixis Investment Managers ("Natixis IM"). She joined Natixis IM in 2015, responsible for overseeing the compliance and internal control functions in Hong Kong, Beijing, Taipei, Seoul, Singapore, Tokyo, Sydney and Melbourne.

Florence has 25 years of experience in the asset management compliance and audit fields. Prior to joining Natixis IM, she held positions as Head of Compliance, Asia Pacific at Allianz Global Investors, Regional Head of Asset Management Compliance at Credit Suisse, and various compliance roles at Franklin Templeton and Prudential Financial, after her first audit role at PwC.

She has been an Executive Committee member of the Hong Kong Investment Funds Association (“HKIFA”) and Co-Chairman of HKIFA Regulatory Sub-committee since 2019. She is also a member of the Hong Kong Academy of Finance.

For HKSAR Government appointments, Florence is a panel member of the Resolvability Review Tribunal and the Securities and Futures Appeals Tribunal. She is also a panel member of the Barristers Disciplinary Tribunal, appointed by the Chief Justice of the Court of Final Appeal.

Florence holds a MBA from the Hong Kong University of Science and Technology, B. Econ from the University of Hong Kong and LLB from the University of London. She is a CPA in Hong Kong and the United States.

Morningstar Asia Limited

Wing Chan is the Head of Manager Research, Europe and Asia-Pacific at Morningstar Asia Limited, a wholly owned subsidiary of Morningstar, Inc. He is responsible for leading Morningstar’s international manager research practices and analyst teams in 11 offices outside of North America, producing qualitative ratings and insightful research for investors around the globe. In addition, Wing oversees the delivery of manager research services to financial institutions and intermediaries in Asia. Chan was previously Director of Manager Research Practice, EMEA & Asia.

Prior to joining Morningstar in 2013, Chan was an investment counsellor for EFG Bank, where he advised on investment solutions and contributed to the bank’s mutual fund research and due-diligence effort in Asia. He also worked as an investment associate for Macquarie Private Bank and as an investment consultant for Lonsec Limited.

Chan holds a bachelor’s degree in economics and finance, with merit, from the University of New South Wales.

Amundi Hong Kong Limited

Kerry Ching has over two decades of experiences in financial industry across different markets in Asia, accumulating deep knowledge of the fund management market and business development. Her most recent role prior to joining Amundi was Managing Director at AMP Capital Asia Limited from 2012 to 2019 where she was responsible for business development.

Before this, Kerry held a number of leadership roles in various global asset managers from 1999 - 2012. She was Country Head at FIL Investment Management (Hong Kong) Limited, Managing Director at UBS Global Asset Management (Hong Kong) Limited and Chief Executive Officer at Invesco Hong Kong Limited.

Kerry received a Bachelor degree in Business Administration from The Chinese University of Hong Kong, an MBA from The University of Western Ontario and a Master of Engineering in e-Commerce from The University of Hong Kong. She is also a CFA and a CAIA charter holder, a CFP and a Canadian CPA.

Chief Executive Officer, Hong Kong

Head of Distribution, Asia Pacific

Schroder Investment Management (Hong Kong) Limited

Amy Cho is the Chief Executive Officer, Hong Kong for Schroders. In her role also as the Head of Distribution, Asia Pacific, she leads both the intermediary and institutional businesses across the APAC region.

Amy has a proven executive management track record and decades of experience driving business growth in the fund management industry. Before joining Schroders in December 2018, she was Managing Director and Regional Head of Business Development, APAC ex-Japan, for Pictet Asset Management. Prior to that, Amy was Director of Sales & Marketing at First State Investments covering Hong Kong and the North Asian markets. Previously, she held senior positions at HSBC Asset Management and Citibank.

Amy also serves on various professional bodies. She is the Vice-chairperson of the Executive Committee of the Hong Kong Investment Funds Association (“HKIFA”). She also sits on the Steering Committee of the Asia Securities Industry and Financial Markets Association (“ASIFMA”).

In advocating gender equality in the financial sector, Amy is a founding executive sponsor of the Hong Kong chapter of Bloomberg Women’s Buy-side Network (“BWBN”), the first women’s buy-side network of its kind in Asia.

In promoting Hong Kong’s financial services, Amy is a member of the Hong Kong Trade Development Council’s (“HKTDC”) Financial Services Advisory Committee.

Amy holds a BSc (Eng.) degree from the Faculty of Industrial Engineering, University of Hong Kong.

Securities and Futures Commission

Ms. Choi is a member of the Securities and Futures Commission (SFC). She is also an Executive Director with responsibility for the Investment Products Division, which is responsible for authorising and supervising collective investment schemes and other investment products as well as for the development and implementation of the SFC’s asset management strategy and policies.

Ms. Choi joined the SFC in 2005. She has extensive regulatory knowledge and experience in the policies and requirements for investment products both in Hong Kong and internationally. She played a lead role in the design and launch of various mutual recognition of funds (MRF) arrangements between Hong Kong and other jurisdictions, in particular the ground-breaking MRF arrangements with Mainland China.

Prior to joining the SFC, Ms. Choi practised as a solicitor in Hong Kong and was a partner of the Corporate Group of the international law firm, Clifford Chance.

Ms. Choi is currently Chair of the International Organization of Securities Commissions’ Committee on Investment Management. She is also a member of the Hong Kong Trade Development Council’s Financial Services Advisory Committee and the Asian Financial Forum Steering Committee.

Ms. Choi chairs the SFC’s Products Advisory Committee and Committee on Real Estate Investment Trusts. She also sits on the Advisory Committee, the SFC (HKEC Listing) Committee and the Executive Committee.

Bank of China (HK) Limited

Arnold Chow is Deputy General Manager, Personal Digital Banking Product Department of BOCHK, overseeing its wealth management products as well as wealth specialists and advisory business in Hong Kong and Southeast Asia. He is also a Director of BOCI Prudential Trustee Limited and a Director of Po Sang Securities and Futures Limited.

Prior to joining BOCHK, Arnold hold various senior executive positions in strategy planning, wealth products and distribution in Hong Kong and mainland China of HSBC Group. He then served as Senior Executive Vice President of Private Banking of Hang Seng Bank.

Arnold started his career in Morgan Stanley (Asia) with expertise in Hong Kong and mainland investment market. He holds a Bachelor degree from the Faculty of Engineering, University of Hong Kong. He is also a Financial Education Committee member of Investor and Financial Education Council (under SFC).

Managing Director, AllianceBernstein Hong Kong Limited

Mr. Nelson Chow is Managing Director of AllianceBernstein Hong Kong Limited, where he is responsible for fund distribution in Hong Kong and China QDII.

Mr. Chow has extensive experience in the industry and led the team to win the Best Retail House Award 2016, 2018, 2020 & 2021 (Asia Asset Management), Greenwich Quality Leader 2019 (Greenwich Associates), Fund House of the Year Award 2013 (Asian Investor) and Metro Finance Hong Kong Leader Choice Award – Excellent Brand of Fund Management 2013, 2014 & 2015.

Before joining AllianceBernstein in 2004, Mr. Chow was the Director of a U.K. asset management firm responsible for fund distribution in Hong Kong and Taiwan.

Mr. Chow earned a bachelor’s degree in Finance & Economics from The University of Western Ontario, Canada and an M.B.A. in Finance from California State University – East Bay, United States. Mr. Chow is the incumbent Chairman of the Hong Kong Investment Funds Association and has been an Executive Committee Member since 2015. He is also appointed as a member of the Products Advisory Committee of Securities & Futures Commission of Hong Kong.

DigFin Group

Author and journalist Jame DiBiasio is editor of DigFin, part of AMTD Digital, a media business covering digital finance, fintech and digital assets (https://www.digfingroup.com). He serves on the board of the Fintech Association of Hong Kong. His book PLANET VC will be out in 2023.

Token Bay Capital

Lucy is the Founder and Managing Partner of Token Bay Capital, a Hong Kong based early-stage venture fund that invests in digital assets and blockchain companies. She is also a Board Member of the FinTech Association of Hong Kong and Founder of Women in Crypto, Hong Kong.

Prior to founding Token Bay Capital, Lucy was a senior leader of PwC’s Global Crypto team where she advised entrepreneurs, start-ups and financial institutions on their crypto and blockchain projects. She also worked with many central banks and other regulatory bodies around the world to help formulate their crypto asset policies. Lucy was named a Top 10 Rising Women in Crypto in 2020 (FinTech Times and Wirex) and #22 Top 100 Women in FinTech in 2021 (FinTech Magazine).

Prior to working in FinTech, Lucy spent 16 years in banking with Goldman Sachs, Credit Suisse, Schroders and Kleinwort Benson. She holds a Type 9 (asset management) license with the Securities and Futures Commission of Hong Kong and became a Chartered Wealth Manager in the UK in 2015. Born and raised in Hong Kong and educated in the UK, she graduated from the University of Oxford with a degree in Modern History.

PwC Hong Kong

Marie-Anne Kong is a Partner in PwC Hong Kong’s Financial Services Division and leads the firm’s Asset and Wealth Management practice (AWM) in Hong Kong. She has over 25 years of experience working in Hong Kong and the UK.

Marie-Anne is a Qualified Accountant (ICAEW, HKICPA) and a member of a number of industry association committees namely: the Regulatory Committee of the Hong Kong Investment Funds Association (HKIFA), Alternative Investment Management Association, Hong Kong Chapter (AIMA), Hong Kong Academy of Finance (AOF) and judging Panel member for Benchmark Fund of the Year Awards. She is a former member of the Share Registrars’ Disciplinary Committee of the Securities and Futures Commission (SFC), Committee on Real Estate Investment Trusts of the SFC, and various working groups of the Financial Services Development Council (FSDC).

Marie-Anne has extensive experience in advising asset and wealth management firms on operational effectiveness, best practices in areas of corporate governance and internal controls, fund start-ups, and regulatory and compliance. She serves clients across the various sub-sectors of the Asset and Wealth Management industry, including hedge funds, private equity, real estate, traditional asset managers and pension funds. She is actively involved with relevant industry associations and policymakers and is an active contributor to market developments.

In Marie-Anne’s capacity as the Asset and Wealth Management Leader in Hong Kong, she engages regularly with key industry players and policymakers to discuss industry developments, opportunities and issues, with a view to help shape the industry and create a better business environment to grow the industry further.

Deacons

Jeremy is a Partner of Deacons in Hong Kong and Head of the Firm’s Investment Funds and Regulatory Practice.

Jeremy qualified as a solicitor in England and Wales in 1991 and was admitted as a solicitor in Hong Kong in 1992. He has over 25 years of experience advising international and local financial institutions in connection with the establishment and regulation of collective investment schemes. He also advises on a wide range of securities, licensing, compliance and regulatory issues relevant to the asset management and securities industry.

Jeremy is director of the Financial Services Development Council as well as the Hong Kong Securities and Investment Institute. He is an executive committee member of AIMA Hong Kong and an active member of various securities industry associations.

Hong Kong Monetary Authority

Mr. Edmond Lau is responsible for external affairs, monetary management and research. He holds a Bachelor of Social Sciences degree in Economics and a Master of Social Work degree from the University of Hong Kong. Mr. Lau joined the Hong Kong Government as an Administrative Officer in 1986. He joined the HKMA in 1997 as Division Head (Banking Development) and had been involved in banking reform and the establishment of the Deposit Protection Scheme. He also served as the Administrative Assistant to the Chief Executive of the HKMA in 2004 after a one year secondment to the Financial Services and the Treasury Bureau. Mr. Lau was promoted as Executive Director (Strategy and Risk) in 2005. He assumed the post of Executive Director (Monetary Management) from 2007 to 2013 when he resigned from the HKMA to pursue further study and, thereafter, take up a leadership role in an NGO. Mr. Lau joined HKMC Annuity Limited as Chief Executive Officer in 2017, and has been on secondment to the HKMA since 1 October 2019. He was appointed as a Deputy Chief Executive of the HKMA on 1 April 2021.

Deacons

Alwyn Li is a key member of Deacons’ investment funds team and is an active member of the firm’s management committee. He has been a partner for over ten years. Alwyn has extensive experience in establishing and seeking SFC authorisation of unit trusts and mutual funds domiciled in Hong Kong and overseas, with particular expertise in ESG funds, RMB-dominated funds, QFI funds and UCITS. He is one of the leading partners in the area of China market entry, including the Hong Kong – Mainland China Mutual Recognition of Funds scheme. Alwyn also advises on fund restructurings, de-authorisation and on-going compliance issues in relation to authorised investment funds and SFC-licensing issues.

Alwyn is a member of the Regulatory Sub-Committee of the Hong Kong Investment Funds Association. He has been recognised as a Leading Individual in Investment Funds 2022 by Chamber and Partners, and was also mentioned for his investment funds work by Legal 500 Asia Pacific in 2022.

Mind HK

Dr. Lucy lord is an Obstetrician & Gynecologist and together with Dr. Rulin Fuong the founding Partner of Central Health Medical Group.

Central Health’s partners, doctors and nurses set up the Patient Care Foundation (PCF) Central Health’s charitable foundation which works to provide vulnerable, stigmatise or deprived groups and communities within Hong Kong with better access to the medical care they need. To help realise this goal in 2016 Dr. Lord founded Mind HK a not for profit which works to improve access to mental health support through its training programmes, campaigns, and bilingual mental health information. Its website resources, youth programmes and information exchanges support frontline mental health charities as well as individuals and their families coping with mental health challenges.

Please visit www.mind.org.hk for more information.

Neptune Digital Limited

Neil is currently the CEO of Neptune Digital, a blockchain joint venture between Kenetic Capital and CryptoBLK. Neptune Digital provides the only fully legal and compliant access to the Permissioned Ethereum Blockchain for NFT, Gaming, Metaverse, and Web3 Applications in China.

Neil has over 20 years of experience in General Management, Corporate Strategy, Mergers & Acquisitions, and Business Development -- across Banking (HSBC, Deutsche Bank), Management Consulting (BCG) and Industry (Philips, Siemens). Prior to Neptune Digital, he was the Head of Business Development Asia Pacific within the Digital Partnerships & Innovation Team at HSBC.

Neil is the Co-Chair of the WealthTech Committee and Member of the InsurTech Committee at the FinTech Association Hong Kong (FTAHK). He is also a Mentor of the China Accelerator Program and Chinese University of Hong Kong (CUHK).

Neil holds a Bachelor of Arts from Brandeis University and a Master of International Management (MBA) from the Thunderbird School of Global Management.

CSOP Asset Management Limited

Ms. Wang joined CSOP Asset Management Limited in 2013. She is now Managing Director, head of Product and Client Strategy Department, responsible for product development, market intelligence and client solutions business of the firm. She holds Master of Finance degree from the University of Hong Kong and Bachelor of Commerce degree from the University of British Columbia.

Fidelity International

Gabriel Wilson-Otto is Director, Sustainable Investing, at Fidelity International.

Based in Hong Kong, Gabriel works closely with Fidelity’s investment professionals to integrate sustainability considerations into investment processes, develop proprietary sustainability ratings, identify long term sustainable investment trends and strategic opportunities, and represent Fidelity’s sustainable investment capabilities to clients.

Gabriel joined Fidelity in 2021 from BNP Paribas Asset Management where he was most recently Global Head of Sustainability Research. Prior to BNPP AM, he was an Executive Director in Goldman Sachs’ Global Investment Research division and Head of GS SUSTAIN for Asia.

Gabriel holds a Bachelor of Commerce (Finance and Economics) and a Bachelor of Information Systems from the University of Melbourne. He is a CFA charter holder.

Mandatory Provident Fund Schemes Authority

As Executive Director (Policy) of the MPFA, Ms. Yee is responsible for development of policy and the retirement scheme legislation under the purview of the MPFA, regulation of MPF related investment, and research and statistics.

She received her BSc and MA in mathematics from the University of Texas at Austin. Before joining the MPFA in 1999, she worked in the insurance and retirement benefits sector in Hong Kong.

Securities and Futures Commission

Alexandra is a senior director in the Investment Products Division of Hong Kong’s Securities and Futures Commission. Her focus is on policy work. Prior to that she was a director of the Securities and Futures Commission’s Corporate Finance Division primarily responsible for developing policies on corporate finance related matters. Alexandra joined the SFC’s Legal Services Division in 1996 and was involved in bringing disciplinary and criminal proceedings under the securities legislation. She joined the Supervision of Markets Division in 2000 and participated in a wide range of policy projects relating to trading and settlement and other operational aspects of the securities industry. After a stint at Morgan Stanley covering compliance, Alexandra rejoined the SFC and in 2009 moved to the Corporate Finance Division. Alexandra is a barrister-at-law.