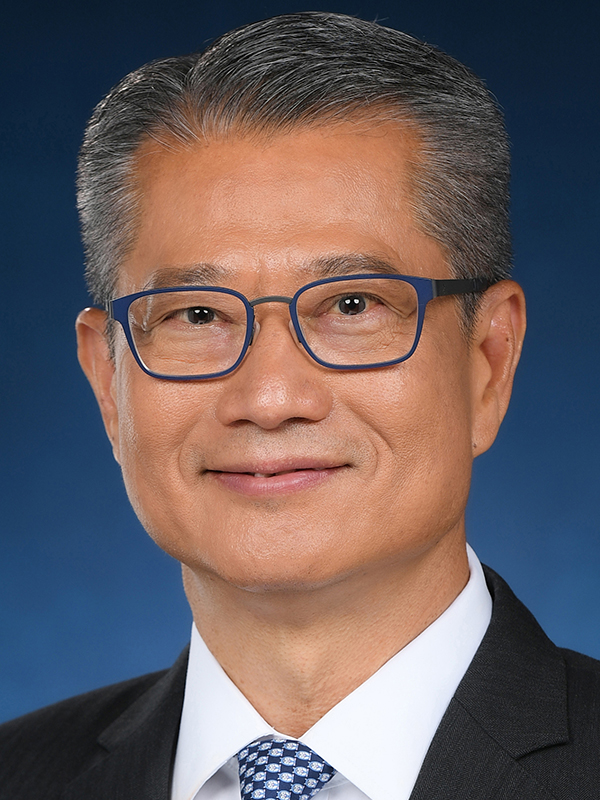

The Honourable Paul Chan Mo-po, GBM, GBS, MH, JP

The Honourable Paul Chan Mo-po, GBM, GBS, MH, JP

Financial Secretary

The Government of the Hong Kong Special Administrative Region

Mr. Chan is a Certified Public Accountant. He is a former President of the Hong Kong Institute of Certified Public Accountants.

Before joining the Government, Mr. Chan held a number of public service positions including member of the Legislative Council and Chairman of Legal Aid Services Council.

Mr. Chan served as Secretary for Development from July 2012 to January 2017. He has been Financial Secretary since 2017.

Julia Leung, SBS, JP

Julia Leung, SBS, JP

Chief Executive Officer

Securities and Futures Commission

Ms. Julia Leung has been Chief Executive Officer (CEO) of the Securities and Futures Commission (SFC) since 1 January 2023.

Ms. Leung joined the SFC in March 2015 as Executive Director of the Investment Products Division. She became Executive Director of the Intermediaries Division in June 2016 and took on the additional capacity of Deputy CEO in March 2018.

In more than 25 years of public service, Ms. Leung has extensive experience in financial regulation, market development and international cooperation. Prior to joining the SFC, Ms. Leung was the Under Secretary for Financial Services and the Treasury from August 2008 to December 2013. Before that, she served at the Hong Kong Monetary Authority for 14 years, spending the last eight years as the Executive Director responsible for financial cooperation with Mainland and other international regulators. Currently, she is the Vice President of the Hong Kong Institute of Bankers and a council member of the Treasury Markets Association.

Ms. Leung graduated from The Chinese University of Hong Kong and earned a master's degree from Columbia University in the City of New York. In 2014, she authored a book on how Asia has surmounted various financial crises.

Eddie Yue, JP

Eddie Yue, JP

Chief Executive

Hong Kong Monetary Authority

Mr. Eddie Yue was appointed Chief Executive of the Hong Kong Monetary Authority (HKMA) from 1 October 2019. He began his career as an Administrative Officer in the Hong Kong Government in 1986. He joined the HKMA upon its establishment in 1993 and was promoted to Division Head a year later. He was appointed Executive Director in 2001 and subsequently Deputy Chief Executive in 2007 before taking up his current position.

Mr. Yue has participated in numerous areas of the HKMA’s work. During his tenure as Deputy Chief Executive, he steered major policies and initiatives relating to reserves management, research, external affairs and market development. Mr. Yue was also actively involved in tackling major financial crises and played an instrumental role in enhancing the Linked Exchange Rate System.

Mr. Yue was educated at the Chinese University of Hong Kong and the Harvard Business School.

Speakers are listed in alphabetical order of their last name.

Tani Burge

Tani Burge

Managing Director, Alternatives Capital Formation

Goldman Sachs Asset Management

Tani is a managing director in Alternatives Capital Formation within Goldman Sachs Asset Management, leading infrastructure capital raising in EMEA. She joined Goldman Sachs in 2024 as a managing director.

Prior to joining the firm, Tani worked at Astatine Investment Partners (formerly Alinda Capital Partners) as a managing director serving as head of Client and Investor Solutions. In this role, she focused on the evolving needs of infrastructure investors across funds, co-investments and separately managed accounts. Tani also sat on the board of one of Astatine's portfolio companies. Prior to this, she worked as a corporate attorney at Linklaters in their Hong Kong and London offices. While in London, Tani also did a business secondment for the chairman of Linklaters where she was responsible for strategy development and implementation, client relationship management and partnership board governance.

Tani earned a Bachelor of Laws (Hons) and a Bachelor of Asian Studies in Mandarin from the Australian National University. She also studied at Peking University, Beijing. Tani is a qualified lawyer in Australia and Hong Kong.

John Cahill

John Cahill

Chief Operating Officer – Asia

Galaxy Digital

John is the Chief Operating Officer for Galaxy Digital (GLXY.TO) Asia, focused on leading the growth of its regional business since 2021. He’s responsible for driving the institutionalization of trading and building the best team in crypto and is passionate about bringing talented people to the industry. Prior to joining Galaxy, John spent 19 years at Goldman Sachs, running hedge fund financing, securities lending and delta-one derivatives across Asia Pacific markets. Along with +20 years of markets experience, John brings expertise in prime brokerage, delta-one trading and financing, as well as in client relationship management, project management, and balance sheet optimization.

Dorothy Chan

Dorothy Chan

Head of Philanthropy Services and Advisory, Asia Pacific

HSBC Global Private Banking

Dorothy Chan is Head of Philanthropy Services and Advisory, Asia Pacific, at HSBC Global Private Banking.

Dorothy has over 20 years of experience working with leaders in the private, public and non-profit sectors to create solutions to catalyse sustainable development.

Prior to joining HSBC, Dorothy was Senior Manager, Corporate Responsibility, at MTR Corporation where she designed and implemented the company's corporate responsibility and sustainability strategy, and introduced a number of customer journey enhancements to meet the changing needs of the community. She also served as Secretary of the board-level Corporate Responsibility Committee.

As Group Public Affairs Manager at CLP Holdings, Dorothy led the group's energy and environment thought leadership and strategic advocacy programmes, and was a member of the board-level Sustainability Committee. During her tenure with The Clinton Foundation as Director of Commitments, Asia, she brokered cross-sector partnerships targeted at alleviating poverty, mitigating climate change, and enhancing social mobility. Dorothy started her career as a country and economic analyst with The Economist Intelligence Unit and the Asia Business Council.

In recognition for her work in integrating environmental and social consideration into managerial practices, Dorothy was selected as a First Mover Fellow by The Aspen Institute in 2013. She is a member of the International Advisory Council of The Fletcher School at Tufts University, a member of the board at the think tank Civic Exchange, and Vision 2047 Foundation.

Dorothy holds a MBA from the University of Chicago Booth School of Business and a Master of Arts in Law and Diplomacy from The Fletcher School at Tufts University, where she was a Carl J. Gilbert Scholar. She received her Bachelor of Arts from Tufts University.

Florence Chan

Florence Chan

Deputy Chief Executive Officer

Po Leung Kuk

Florence Chan is the Deputy Chief Executive Officer of Po Leung Kuk, a leading NGO in Hong Kong providing multifaceted and quality services to all ages in the community through its over 300 service units. Florence supervises Po Leung Kuk’s Education Affairs, Cultural Services, Fundraising and Administration Departments. She also acts as the key interface between the Board, its functional committees and internal departments.

Previously, Florence served in various Government bureaux and departments. Her experience stretches from education, law, environmental protection and industry support.

Lily Chan

Lily Chan

Managing Director, Asset & Wealth Management, Hong Kong

Goldman Sachs

Lily is responsible for the Asia Alternative Capital Markets Group (ACM). ACM is responsible for sourcing, creating, marketing and providing ongoing investor relations for the alternative investments offered by the firm. These include private equity funds, hedge funds, real estate funds, mezzanine funds, opportunistic funds, co-invest opportunities and private placements. Lily joined Goldman Sachs as an associate in 2012 and was named managing director in 2017.

Prior to joining Goldman Sachs, Lily was on the hedge fund investment team at Archer Asia, an Asian focused fund of funds, where her responsibilities included portfolio management, investment due diligence and hedge fund advisory services. Prior to that, she was at Credit Suisse Asset Management and KBC Asia Fund of Funds. She worked at KBC Fund of Funds during the Institutional Year of the Year 2005 and Best Asian Fund of Funds 2007 Eurekahedge. In this role she was responsible for hedge fund investment due diligence, manager selection and advisory services.

Lily earned a Bachelor of Commerce in Accounting from the University of Queensland in Australia.

Carmen Cheng

Carmen Cheng

Special Counsel

Karas So LLP in Association with Mishcon de Reya

Carmen Cheng is a Special Counsel of Karas So LLP in Association with Mishcon de Reya. She is a private client lawyer with a practice focused on family matters such as divorce and children issues, contentious and non-contentious trusts and estate matters and applications in respect of mentally incapacitated persons. She advises on all aspects of family law including ancillary relief proceedings, custody and access of children, relocation and pre- and post-nuptial agreements.

She regularly assists clients on wealth and succession planning, including drafting Wills for high net-worth individuals with assets in multi-jurisdictions, probate applications for Hong Kong and overseas estates and establishment of trusts. With extensive experience in family governance, Carmen has previously assisted families in the Asia-Pacific region in planning for their inter-generational wealth transfer during her tenure at a global financial institution.

Her expertise and dedication have earned her nominations by peer practitioners in the Private Client Global Elite Directory in 2023 and 2024.

Raj Dhanda

Raj Dhanda

Partner and Global Head of Wealth Management

Ares Wealth Management Solutions

Mr. Dhanda is a Partner and Global Head of Wealth Management within Ares Wealth Management Solutions, which oversees product development, distribution, marketing, and client management activities across Ares' investment offerings in the global wealth management channel. Prior to joining Ares in 2021, he was the Chief Executive Officer at Black Creek Group, which he joined in 2016 as President before being named Chief Executive Officer in April 2018. Mr. Dhanda also serves on the Board of Directors for Black Creek Diversified Property Fund Inc. and as Co-President of both Black Creek Diversified Property Fund Inc. and Black Creek Industrial REIT IV Inc. While at Black Creek, Mr. Dhanda led the evolution to a one firm brand as Black Creek Group, and oversaw significant capital raise, acquisitions and developments. Previously, Mr. Dhanda spent 26 years at Morgan Stanley, where he held a variety of leadership roles, including leading key divisions of their institutional and wealth management platforms, Head of Investment Products and Services for their wealth management division, and serving on the Executive and Operating Committees for their wealth management division. Throughout his career at Morgan Stanley, Mr. Dhanda helped develop strategies for changing regulations and technology to advance the company's wealth management channels. Mr. Dhanda serves on the Brown University Real Estate Group Advisory Board. He holds a B.A. from Brown University in Economics and Organizational Behavior & Management.

Dany Dupasquier

Dany Dupasquier

Managing Director, Head, Fund and Alternative Selection, Wealth Management

Standard Chartered Bank

Dany Dupasquier is Head of Fund and Alternative Selection at Standard Chartered Bank’s Group Wealth Management unit. He has global responsibility for developing and managing the Bank’s managed investments platform across all asset classes and segments, from traditional fund managers overseeing equity, fixed income and multi-asset portfolios to alternative investment strategies.

Dany joined Standard Chartered Bank in July 2009 and has over 30 years of experience in the banking sector. He was previously with Lombard Odier in Geneva and Singapore where was a Vice President/Analyst in the Funds of Hedge Funds unit. His mandate included sourcing, analysis and selection of hedge fund managers for the private bank’s in-house funds of funds. Prior to that, Dany was based in Lombard Odier’s Geneva office where he started his career in the Geneva-based private bank in 1991. Dany is a CFA charter holder.

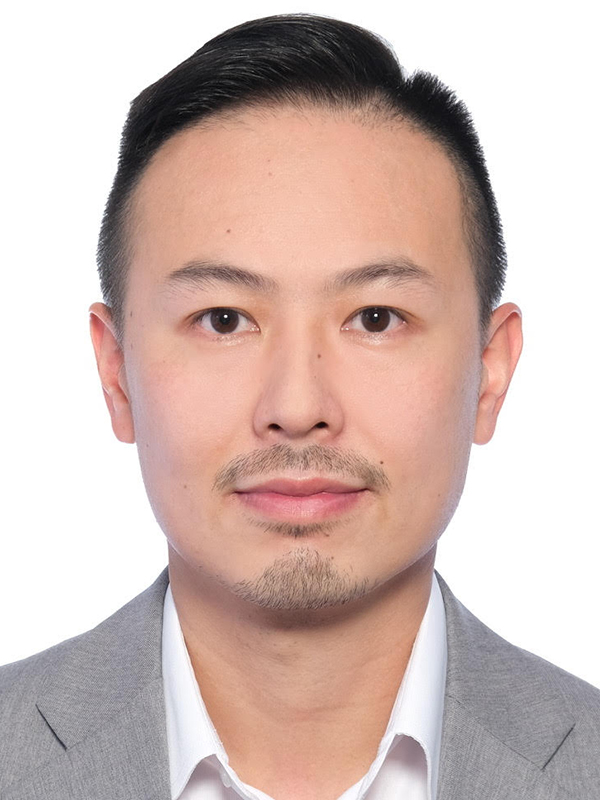

Jason Fong

Jason Fong

Global Head, Family Office of Invest Hong Kong

The Government of the Hong Kong Special Administrative Region

Mr. Jason Fong was appointed as the Global Head of FamilyOfficeHK, Invest Hong Kong (“InvestHK”) in April 2023. InvestHK is the department of the Hong Kong SAR Government, and FamilyOfficeHK at InvestHK is responsible for promoting Hong Kong as the international hub and preferred choice of family offices.

Mr. Fong is a veteran in the banking and asset management industry with over 27 years of experiences before joining FamilyOfficeHK. He has held various senior positions with international financial institutions over his career and he has wide exposure in the Asia Pacific region including Mainland China, Hong Kong, Taiwan China, Singapore, Malaysia, Philippines, Japan and Korea. Mr. Fong was re-located to China and based in Beijing, Shanghai and Shenzhen, during his terms with international banks to take up onshore leadership.

Mr. Fong spent his early years in United Kingdom and graduated from the University of Leeds. He is an expert in family business and family office. He served as a senior consultant to banking associations and government advisory bodies. Mr. Fong is also the member of HKTDC Financial Services Advisory Committee and Steering Committee member of Asian Financial Forum.

Mathieu Forcioli

Mathieu Forcioli

Global Head and Asia-Pacific Head of Alternatives

HSBC Wealth and Personal Banking

Mathieu is currently Global Head and Asia Pacific Head of Alternatives, in our Global Private Banking and Wealth Division, based in Hong Kong. In this capacity, he oversees the offering of hedge funds, private equity funds, Real Estate funds and other private investment opportunities to HSBC’s private banking and wealth customers.

Prior to joining HSBC, Mathieu set-up the private markets offering of Antarctica Asset Management, a global platform allowing wealth managers to offer their clients access to a curated offering of hedge funds and private market funds. Before that, Mathieu set up and grew the Asia operations of Moonfare, an online platform allowing private individuals to invest in Private equity funds.

In the earlier part of his career, Mathieu held various leadership roles at UBS, including leadership of the Wealth Management Private Markets Distribution team and the Institutional Investments group for APAC. Mathieu also held equity capital markets, structuring and derivatives positions in the investment banking divisions of UBS, Merrill Lynch and Calyon in London and Paris.

Mathieu holds a Master’s degree in Applied Mathematics for Finance from Ecole Centrale Paris.

.jpg) Jeremy Hall

Jeremy Hall

CEO Brookfield Singapore and

Head of APAC Brookfield Oaktree Wealth Solutions

Jeremy Hall is a Managing Director and Head of Asia Pacific for Brookfield Oaktree Wealth Solutions.

In this role, he is responsible for developing and maintaining relationships with wealth intermediaries across the Asia Pacific region.

Mr. Hall joined Brookfield in 2016 and was formerly Head of Brookfield’s Public Securities business across the Asia Pacific. Before joining Brookfield, Mr. Hall was a Director at Prudential (UK) PLC’s asset management business. Prior to that, he was Head of Client Relations for Deutsche Asset Management’s alternative asset management business.

Mr. Hall holds a Master’s and Bachelor of Business degrees from the University of Technology, Sydney.

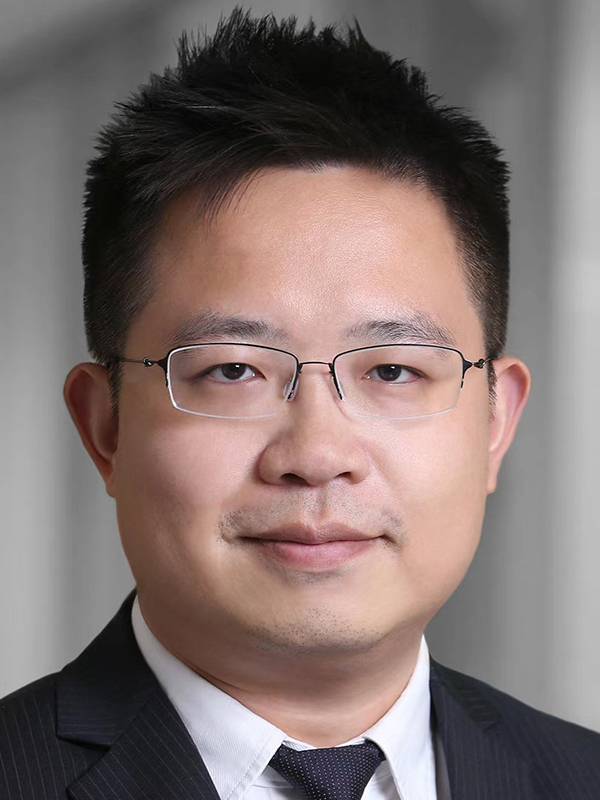

Ed Huang

Ed Huang

Head of Private Wealth Solutions - Asia Pacific

Blackstone

Ed Huang is a Senior Managing Director and Head of Asia-Pacific (APAC) for Blackstone’s Private Wealth Solutions Group based in Hong Kong. Private Wealth Solutions’ mission is to bring institutional quality products across a broad spectrum of alternative asset classes to individual investors and their advisors.

Mr. Huang joined Blackstone in 2012, and Private Wealth Solutions in 2024. Prior to his current role, Mr. Huang was COO of Asia Private Equity, Head of BCP Asia Acquisitions, and led Greater China and Korea for Blackstone’s Private Equity Group. Mr. Huang has led or been involved in Blackstone’s investments in Ennovi/Interplex, Geo-Young, SHP Packaging, Global Sources, Pactera, and Simone.

Before joining Blackstone, Mr. Huang was previously a Managing Director for China investments at Morgan Stanley Private Equity Asia and worked in investment banking for Morgan Stanley and Merrill Lynch in New York and Hong Kong.

Mr. Huang received a B.A. from Yale University and an M.B.A. from Harvard Business School. Mr. Huang serves as a director on the boards of Ennovi/Interplex, Geo-Young and SHP Packaging. He is also director on the boards of the China and Hong Kong Venture Capital and Private Equity Associations, and a member of the Yale Asia Development Council.

Iqbal Khan

Iqbal Khan

President UBS Asia Pacific and

Co-President UBS Global Wealth Management

Iqbal Khan became Co-President UBS Global Wealth Management and President UBS Asia Pacific in 2024. He previously led Global Wealth Management for two years and also headed UBS Europe, Middle East and Africa from 2021 to 2023. He joined UBS in 2019 as Co-President Global Wealth Management. He is a member of the UBS Group Executive Board.

Prior to UBS, Iqbal was at Credit Suisse where he held senior leadership positions as CFO Private Banking & Wealth Management and later CEO International Wealth Management. From 2001 to 2013, Iqbal held numerous leadership positions at Ernst & Young, where he was one of the youngest partners of the firm’s Swiss arm.

Iqbal holds an Advanced Master of International Business Law degree (LLM) from the University of Zurich. In addition, he is a Certified International Investment Analyst, a Swiss Certified Public Accountant, a Swiss Certified Trustee and a Member of the Board of the UBS Optimus Foundation.

Vivien Khoo

Vivien Khoo

Chief Executive Officer and Managing Director

Private Wealth Management Association

Vivien is the CEO of Private Wealth Management Association (“PWMA”) with close to three decades of experience in wealth management, digital assets, crypto research, compliance and regulatory oversight.

Vivien spent close to two decades at Goldman Sachs, where she was the Managing Director of Goldman Sachs’ Asia Pacific Ex-Japan Compliance division. At Goldman Sachs, Vivien was involved in various market and regulatory reforms, she was also an ex regulator at the Hong Kong Securities and Futures Commission earlier on in her career.

Prior to joining the PWMA, she was the Chairwoman and co-founder of the Asia Crypto Alliance, an industry association promoting a sustainable ecosystem for virtual asset providers in Asia. After a long career in senior compliance and regulatory roles, Vivien moved into the digital asset industry in 2019 where she was the Global Chief Operating Officer and Interim CEO at a leading crypto derivatives exchange. She also held senior roles at various major digital wealth management and crypto firms, including StashAway and Delphi Digital. Vivien serves on the Regulatory Subcommittee of the Task Force on Promoting Web3 Development established by the Government of HKSAR in 2023, chaired by the Financial Secretary with participation of key government officials and financial regulators.

As a strong advocate for diversity and inclusion, Vivien was a key sponsor for female programs at different levels during her time at Goldman Sachs. She is the founder of W3W (Web3Women) and co-founder of SatoshiWomen, both of which provide education, inspiration and connections to women interested in digital assets. She serves on the board of Inspiring Girls and is a fellow of Social Enterprise Research Academy. Vivien was named a honouree of Tatler Asia’s Most Influential List in 2022.

Felix Kwok

Felix Kwok

VP, Head of Modern Art, Asia

Sotheby's

Felix Kwok graduated from the Faculty of Arts at the University of Hong Kong. After joining Sotheby's in 2012, he was promoted to the head of Modern Art, Asia department of Sotheby's at the end of 2020. In 2022, he was selected as "40 Under 40 Asia-Pacific" by the nearly century-old Apollo Art Magazine in the UK.

Since joining Sotheby’s, Mr. Kwok has played an instrumental role in promoting the internationalization of Asian modern art and introducing Western modern art to Asia. He has repeatedly achieved many great auction records, including the world auction record for the international Chinese abstract master Chu Teh-Chun with HK$230 million, six of the top seven Asian auction records for Pablo Picasso, including the top auction record of HK$191 million, the top four world auction records for any Vietnamese artwork, and the world auction records for more than a dozen global post-war artists. In 2021, Mr. Kwok facilitated the unprecedented collaboration between Sotheby's and international film director Wong Kar Wai, creating the first Asian film NFT auction. He also curated the Wong Kar Wai’s film retrospective auction, causing a sensation at the time. During the Modern Art Evening Auction in 2022, he curated the sale of Sir Run Run Shaw Collection, the legendary Chinese entrepreneur and philanthropist. All of the above curated auctions achieved white glove results.

As an auctioneer of Sotheby's, Mr. Kwok achieved two of Sotheby's world auction records in Chinese Paintings, including the Five Drunken Princes Returning on Horseback by Yuan Dynasty artist Ren Renfa for HK$306 million in October 2020, and Zhang Daqian’s "Landscape after Wang Ximeng" for HK$370 million in April 2022. He also took the rostrum at the 2019 UCCA Gala Charity Auction. Felix was selected as one of ‘The Most Influential People in Art’ in the ‘Business of Art Power List’ by Observer in 2024.

Giselle Lai

Giselle Lai

Associate Investment Director, Digital Assets

Fidelity International

Gisella Lai is an Associate Investment Director of Digital Assets at Fidelity International, where she has been supporting the firm's digital assets strategy from crypto solutions to tokenisation since 2022. Giselle drives client engagement in digital assets globally and support the distribution of Fidelity Physical Bitcoin ETP. Additionally, she actively contributes to the development of educational content and research in the field of digital assets.

Passionate about new technologies, Giselle has been an enthusiast in digital assets since 2018 and she holds a Master of Science in Blockchain and Digital Currency from the University of Nicosia. She is also an active member of the Web 3 Women association.

Prior to her current role, Giselle was an Associate Investment Director in the Asian Fixed Income team, specialising in Asian Investment Grade and China bonds markets. She led the day-to-day product responsibilities for the Asian Investment Grade franchises, including investor communications, client engagement, and portfolio manager support.

Giselle joined Fidelity as a graduate associate and gained experience across various areas, including Multi Asset Investment Directing, Institutional Business & Consultant Relations, Digital Solutions, and Intermediary Sales in both Hong Kong and Singapore.

She holds a BSc degree in Economics and Finance from the University of Hong Kong and is a CFA and CAIA charterholder.

Carly Lau

Carly Lau

Senior Reporter

Asian Private Banker

Carly Lau is a senior reporter at Asian Private Banker, bringing nearly five years of dedicated experience to her role. Specializing in the private wealth management sector across the Asia-Pacific region, Carly's primary focus lies in North Asia. Her expertise extends to tracking investment trends within the region, where she frequently engages with fund houses and CIOs of private banks to gain insights into various asset classes.

In addition to her reporting responsibilities, Carly also moderates panels for internal events as well as assists to host client events.

Carly holds a Bachelor of Arts from Monash University.

Michael Lau

Michael Lau

Senior Vice President, Group Head of Business Development at Bullish, and

Chairman of Consensus Hong Kong

Michael serves as Senior Vice President, Group Head of Business Development at Bullish, and Chairman of Consensus Hong Kong. He is responsible for global business development efforts across the Bullish group ecosystem including the regulated Bullish Exchange, CoinDesk, and Coindesk Indices. In addition, Michael leads strategy, partnership, and development efforts for Consensus Hong Kong - CoinDesk’s flagship cryptocurrency, blockchain, and Web3 event in Asia.

Michael joined the financial services division in early 2020 to lead the institutional sales and marketing of the crypto exchange product that is now known as Bullish. He has held several roles at Bullish and was most recently Senior Vice President, Global Head of Sales.

Michael holds over a decade of experience in traditional capital markets. He previously served as Global Chief Marketing Officer of CLSA, a leading capital markets and investment group, where he spearheaded marketing initiatives for the firm’s alternative asset management, corporate finance, capital markets, securities, and wealth management products and services. Michael’s experience spans his role as Chief Operating Officer, Equity Advisory at CLSA as well as several positions within the equities business at J.P. Morgan.

Originally from Canada, Michael holds a Bachelor of Applied Science in Industrial Engineering from the University of Toronto, a Postgraduate Diploma in Strategy & Innovation from the Saïd Business School at the University of Oxford, and a certificate of participation in the Chief Marketing Officer Program from the Kellogg School of Management at Northwestern University.

Lemuel Lee

Lemuel Lee

Managing Director, Head of Wealth Management Hong Kong

BNP Paribas

Lemuel Lee is Head of Wealth Management Hong Kong for BNP Paribas. He is responsible for implementing wealth management’s growth strategy while supporting its teams of talented bankers to deliver value added solutions to clients in line with our One Bank strategy.

Lemuel joined BNP Paribas’ wealth management division in 2017 as Head of Investment Services, Hong Kong and Deputy Head of Investment Services, Asia Pacific. He was responsible for overseeing the delivery of the Bank’s investment offering and advisory to clients across traditional and digital channels, the development of discretionary and advisory services as well as the advancement of new initiatives.

Lemuel has over 20 years of investment banking and wealth management experience. Prior to joining BNP Paribas, he was Head of Equities, Asia for J.P. Morgan Private Bank. He also held a long tenure of eight years with J.P. Morgan Corporate & Investment Bank, assuming various leadership positions in equity derivatives distribution and marketing.

Before joining J.P. Morgan, he was with Bear Stearns and Bank of America Merrill Lynch in capital market roles across Hong Kong, Japan, London and New York.

Lemuel obtained a Master’s degree in Commerce and a Master’s in International Business from the University of Sydney. He also holds a Bachelor’s degree in Commerce and a Bachelor’s degree in Laws from the University of New South Wales.

Rachael Lee

Rachael Lee

Senior Vice President

Howden Private Wealth

Rachael brings over 15 years of experience in the wealth transfer planning industry, specializing in sourcing insurance solutions from highly rated international carriers for private bank clients. Fluent in English, Mandarin, and Cantonese, she primarily serves clients in North Asia. Prior to joining Howden Private Wealth, Rachael held a similar position at a leading insurance brokerage.

Originally from Singapore, Rachael spent 7 years as a Relationship Manager before transitioning into wealth transfer planning. She dedicated 5 years at United Overseas Bank, managing Singaporean clients, followed by 2 years at Citibank International Personal Bank, where she focused on Indonesian clients. Her responsibilities included portfolio management, client education on investment strategies, and new client acquisition.

Rachael graduated with a Bachelor of Arts and Social Sciences from the National University of Singapore.

Ronald Lee

Ronald Lee

Head of Private Wealth Management in Asia Pacific

Goldman Sachs (Asia) L.L.C.

Ron is head of Private Wealth Management in Asia Pacific. He is a member of the Asia Pacific Management Committee, Asia Pacific Inclusion and Diversity Committee and the Global Inclusion and Diversity Committee.

Before assuming his current role in 2011, Ron was in the Investment Banking Division (IBD), where his responsibilities included head of the investment banking business in Hong Kong, head of the financial sponsors practice and co-head of the industrials group. He joined Goldman Sachs in 1998 in the Fixed Income, Currency and Commodities Division and joined IBD in 2001. He was named managing director in 2003 and partner in 2006.

Prior to joining the firm, Ron worked in the Corporate Finance and Capital Markets Departments at JP Morgan in New York, Tokyo, Singapore and Hong Kong. Ron earned a BA in History and Literature from Harvard College.

Martin Leung

Martin Leung

Head of Private Investments Hong Kong

BNP Paribas Wealth Management

Martin has over 16 years of experience in private equity investing. Prior to joining BNP WM, Martin was a Director with Credit Suisse/UBS, where he was responsible for the sales and advisory of private equity funds and product onboarding. He was also previously with Noah HK Holdings, where he was responsible for product due diligence and selection. Prior to this, he was with SumiTrust as gatekeeper on the institutional side covering private equity investments for pension and institutional clients. He has a Degree in Economics from the University of Toronto.

Amy Lo, JP

Amy Lo, JP

Chairman, Executive Committee, Private Wealth Management Association;

Chairman, UBS Global Wealth Management Asia,

Head and Chief Executive, UBS Hong Kong

Amy Lo is Chairman, Global Wealth Management Asia, Co-Head of Wealth Management Asia Pacific, Head and Chief Executive of UBS Hong Kong, and a Managing Director at UBS. Amy has over 30 years of experience in the banking industry. Since joining UBS in 1995, she has held a number of senior management positions including Regional Head of Ultra High Net Worth and Global Family Office in Asia. Today, the ultra-high net worth business is the leading wealth manager for ultra-high net worth individuals in the region.

Actively involved in the development of the private banking industry in Hong Kong, Amy chairs the Executive Committee of the Hong Kong Private Wealth Management Association (PWMA), and is a Board Member of the Hong Kong Financial Services Development Council (FSDC) and the Hong Kong Academy for Wealth Legacy. She is also a member of the Banking Industry Training Advisory Committee of the Hong Kong Education Bureau and an advisor of Our Hong Kong Foundation.

A passionate supporter of youth education and technological innovation in Greater China, Amy is a member of The Court and the MBA Advisory Board at The University of Hong Kong, and a member of the Advisory Committee of the Department of Social Work at The Chinese University of Hong Kong. She is also a Board Member of the UBS Optimus Foundation, the independent grant-making foundation that helps UBS clients improve the education and welfare of children globally.

In recognition of her contribution to the wealth management industry, Amy was named Private Banker of the Year in the Asian Private Banker Awards for Distinction 2020 and 2023. She also received the Executive Award at the DHL/SCMP Business Awards 2018 for her efforts in building UBS as a corporate citizen in Hong Kong. She was also named by a top-tier Chinese media, China Business News, as one of the "Hong Kong Top 20 in the next 20 years" for her contribution to innovation developments in 2017.

Dr. Andrew Lo

Dr. Andrew Lo

Head A&S Family Advisory North Asia

Global Wealth Management

UBS AG

Andrew heads A&S Family Advisory and advises UHNW families on investment management, family governance, setting up family office, and family’s Next Gen’s training & development. He has worked with wealth planners to structure family trusts (including Pre-IPO trust) and assisted clients in managing liquidity events. Prior to private banking, he was a professional engineer and worked in Schneider Electric.

He sits on University of Oxford’s China Advisory Group and gives counsel on regional alumni and development matters. Andrew is also a member of the awards committee at China Oxford Scholarship Fund and helps with scholarship award selection for master’s and doctoral degree studies at Oxford University.

Dr. Lo received a doctorate in business from The University of Manchester, an MSc in Management Research (finance) from the University of Oxford, BASc (mechanical engineering) from the University of Toronto and a CAIA charter in alternative investment.

April Lok

April Lok

Head of Business Development

Howden Private Wealth

April Lok is the Head of Business Development in Howden Private Wealth Hong Kong Office. She plays a pivotal role in shaping the strategic direction of the organization, spearheading the development and implementation of comprehensive business plans, identifying and securing new opportunities with different banks, partners, and organizations.

Prior to her current role, April was a media professional with almost 10-year experience, anchored prime-time news broadcasts, covering a wide range of topics, from politics and business to local interest stories and producing different types of informative program. April leverages her diverse skill set to drive the organization's strategic growth and expansion.

April holds a B.A. from the City University of Hong Kong, and a M.P.A in the University of Hong Kong.

Wai Soon Lum

Wai Soon Lum

Head of Wealth Planning Hong Kong, Managing Director

UBS Global Wealth Management

Wai Soon LUM is a Managing Director, Head Wealth Planning UNHW in Hong Kong. She leads a team of Wealth Planners who provide wealth planning services to UHNW families in Greater China. She has more than 12 years’ international experience helping Asian families with their succession planning, tax and estate planning, cross border investment and philanthropic needs.

Prior to joining UBS, Wai Soon was previously the Head of the Strategic Wealth Advisory Team at Goldman Sachs in Hong Kong and had held a number of client facing roles in the trust and estate industry. She started her career in legal practice as a corporate lawyer specializing in Mergers and Acquisitions.

She graduated with an LLB ( from the Faculty of Law, National University of Singapore and was an Advocate and Solicitor of the Supreme Court of Singapore. She is a member of the Society of Trust and Estate Practitioners and Singapore Academy of Law.

Edward Moon

Edward Moon

Partner, Head of Asia Pacific Global Wealth

Apollo Global Management

Edward Moon is a Partner and Head of Asia Pacific Global Wealth in the Client and Product Solutions group at Apollo. Prior to joining in 2022, Edward was Managing Director and Head of Alternative Investments, Asia Pacific at HSBC Global Private Banking. Previously, he was Executive Director and Head of Hedge Funds and Liquid Alternatives at Bank of Singapore and served as CIO of Woori Absolute Partners before that. Earlier in his career, Edward served as Co-CIO and Managing Partner at EDGE Holdings Ltd.; as VP and Head of Equity Capital Markets (Korea) at Citigroup, and co-established Credit Suisse’s representative office in Korea.

Edward holds an MBA from INSEAD and an AB with Honors from Brown University. He has received ten industry awards over his career, most recently winning ‘Best Alternative Advisory’ Award by Asian Private Banker 2021, marking his 6th industry award in wealth management.

Rocky Mui

Rocky Mui

Partner

Clifford Chance

Rocky is a Partner of Clifford Chance (Hong Kong) who leads the Asset Management and Financial Regulatory Group, and the Fintech practice in Hong Kong. He specialises in financial regulatory advice, Fintech, fund formation, PRC investment programs (QFI/Connect Schemes), cross-border mergers & acquisitions and general corporate related work.

Rocky is a senior member of Clifford Chance's global Tech group and strategy committee. In particular, he has developed expertise in blockchain and virtual assets related matters. He is a member of Hong Kong Academy of Finance, and also various Hong Kong FSDC sub-committees involving Fintech and financial regulatory areas. He is also a member of the Fintech Committee of the Private Wealth Management Association, and other Fintech / financial regulatory committees of various industry associations.

He is admitted in Hong Kong, New South Wales Australia, and England and Wales. He was previously an associate member of CPA Australia.

Aik-Ping Ng

Aik-Ping Ng

Head of Family Office Advisory, Asia Pacific

HSBC Global Private Banking

Aik-Ping Ng is Head of Family Office Advisory, Asia Pacific at HSBC Global Private Banking. Aik-Ping is responsible for providing professional advisory on setting up, implementing and review of tailor-made family office and business legacy solutions for ultra-high net worth (UHNW) business families.

Aik-Ping is a seasoned investment and private wealth management professional with over 18 years of rich international and China-based experience spanning private equity, corporate finance, family office advisory, asset management, strategic M&A and operational development.

Prior to joining HSBC, Aik-Ping was Senior Advisor at UBS Global Wealth Management’s Family Advisory and Philanthropy Services in Asia Pacific. He worked closely with Asian UHNW clients in the formulation, review and implementation of family legacy solutions. Before that, Aik-Ping was at a Beijing-based multi-family office, where he led an international team to develop and implement family office solutions for Chinese entrepreneurs with heritage planning and wealth sustainability needs. Before that, he was a founding member of a USD 700mn private equity fund sponsored by Standard Chartered Bank based in Beijing.

He is also adjunct faculty at Renmin University of China - Queen’s University Smith School of Business Master of Finance program, which has been approved by China’s Ministry of Education. He is part of the faculty team at Singapore Wealth Management Institute and also taught executive courses at Singapore Management University.

Aik-Ping holds Master of Science degrees in Financial Engineering and Management Science & Engineering from Columbia and Stanford Universities, and a Bachelor of Science (Distinction) degree in Industrial Engineering from Stanford University. He is also a certified Trust and Estate Practitioner with Society of Trust and Estate Practitioners (STEP), a certified Enneagram coach and a qualified family business and wealth advisor from Family Firm Institute.

Marco Pagliara

Marco Pagliara

Head of Emerging Markets, Private Bank

Member of the Private Bank Executive Committee

Deutsche Bank AG

Marco Pagliara was appointed Private Bank’s Head of Emerging Markets (EM), including Asia Pacific, Middle East Africa and Latin America, in June 2023. He is a member of the Private Bank’s Executive Committee and reports to Claudio de Sanctis, Member of Deutsche Bank’s Management Board and Head of the Private Bank.

Before relocating to Singapore in August 2023, Marco was Deutsche Bank’s Head of International Private Bank EMEA, CEO of Deutsche Bank (Switzerland) Ltd. and Chief Country Officer for Switzerland, since 2019.

He joined Deutsche Bank from Goldman Sachs in June 2019 as Market Head Northern & Eastern Europe, covering the business in the UK, the Nordics, Luxembourg, domestic Switzerland and Emerging Europe.

Marco began his career with McKinsey & Company Inc. in Milan before joining Goldman Sachs in 2002. During his 18 years at Goldman Sachs, he held various management positions before becoming head of the wealth management business in Continental Europe and Switzerland in Zurich, and where he served as the General Manager of Goldman Sachs Bank AG (Switzerland).

Marco holds a degree in business administration from Bocconi University in Milan, and an MBA in Finance from Columbia Business School, New York.

Stephen Pak

Stephen Pak

Director, Citi Global Wealth Alternative Investment

Citi Private Bank

Stephen is an Alternative Specialist and is responsible for driving Citi Global Wealth’s alternative investment’s business in North Asia, including advisory, product support, content and manager sourcing. Prior to joining Citi Private Bank, Stephen was Executive Director at UBS Investment Bank where he led the APAC Capital Introduction team, providing advisory content and business development services to UBS’s hedge fund clients. Prior to UBS, he was the head of Credit Suisse liquid alternatives in Asia. Before joining Credit Suisse, he conducted Asia hedge fund manager research at SAIL Advisors, a Hong Kong family office. Stephen started his buy side career with Goldman Sachs Asset Management’s Asia ex Japan equity team. Stephen is a Chartered Financial Analyst and holds an MBA from the UCLA Anderson School of Management as well as BA in Economics and Psychology from the University of California, Los Angeles.

Harshika Patel

Harshika Patel

Chief Executive Officer, Asia Private Bank

J.P. Morgan

Harshika Patel is the Chief Executive Officer of J.P. Morgan Private Bank in Asia. She is also Chair of J.P. Morgan’s Asia Pacific DEI Council, where she helps to lead the strategy for the firm’s diversity and inclusion initiatives in the region.

Harshika has over three decades of experience in financial services. She joined J.P. Morgan as Managing Director in 2013 and most recently served as the Chief Executive Officer of J.P. Morgan in Hong Kong while she was in her role as the Head of Firmwide Strategy for Asia Pacific. In this role, she was responsible for driving and implementing the firm’s strategy across its 17 operating markets in Asia Pacific. Prior to moving to Hong Kong, she was based in Singapore where she led the Asia Commodities Sales and Structuring business and the Electronic Sales business, delivering electronic trading services across macro products to institutional clients.

Before joining J.P. Morgan, Harshika was at Barclays Capital for 10 years where she held a number of key roles including Deputy Treasurer for Barclays Capital, and Global Chief Operating Officer for the Commodities business. She was previously a Senior Manager in the Financial Services Practice at Deloitte London providing assurance and advisory services to global financial institutions.

She also holds various board member roles. Most recently, she served as Chair of the Asia Securities Industry & Financial Markets Association (ASFIMA), the leading Asian financial trade association focused on developing regional capital markets.

Harshika received her Bachelor’s degree in Computer Science & Accounting from Manchester University and is an ICAEW qualified Chartered Accountant.

She resides in Hong Kong with her husband and two children.

Keith Pogson

Keith Pogson

Senior Partner, Asia Pacific

Ernst & Young

Mr. Keith Pogson is the Senior Partner, Financial Services, Asia Pacific at Ernst & Young (EY). Keith has been based in Asia for over 28 years, and has held a number of leadership roles both regionally and globally within EY. He has a strong focus on regulatory change and relationships, and brings a wealth of networks and contacts across the industry.

He was the Chairman in 2022-23 of the Listing Committee of The Stock Exchange of Hong Kong Limited, Deputy Chairman 2020-22 and a member since 2016. He is a former President of the Hong Kong Institute of Certified Public Accountants (HKICPA), and continues to be a member and is the Chairman of the Governance Committee. He was previously the Chairs of the Regulatory Oversight Board, the Audit Committee, the Ethical Standard Setting Committee, the Assurance Standards Setting Committees and the Professional Conduct Committees of the HKICPA. Mr. Pogson was the Honorary Advisor for the Accounting and Financial Reporting Council of 2018-2023. He is also the member of ME Advisory Group, Financial Services Development Council (“FSDC”). He is presently the Co-Chair of the Bank Working Group of the Global Public Policy Committee (GPPC) of the Big 4+2 firms, the forum through which the Big4+2 Accounting Firms interact with the Financial Stability Board and the Basel Committee.

Mr. Pogson is a Fellow and Practicing Member of the HKICPA, a Fellow of the Institute of Chartered Accountants in England & Wales, a Fellow of the Hong Kong Securities and Investment Institute as well as Member of Hong Kong Academy of Finance.

Jean Eric Salata

Jean Eric Salata

Chairman of EQT Asia and

Head of EQT Private Capital Asia

Jean Eric Salata is the Chairman of EQT Asia and Head of EQT PC Asia. Jean started the regional Asian private equity investment program for UK-based Baring Private Equity Partners Ltd in 1997 and later led the management buyout of this program in 2000 to establish BPEA as an independent Firm. He has since been responsible for the investment activity of BPEA, and now EQT PC Asia.

Prior to joining EQT, Jean was a Director of Hong Kong-based AIG Global Investment Corporation (Asia) Ltd., the Asian private equity investment arm of AIG. Prior to that, Jean was the Executive Vice President of Finance of Shiu Wing Steel, a Hong Kong-based industrial concern, and prior to that a management consultant with Bain & Company based in Hong Kong, Sydney and Boston.

Jean holds a B.S. (Hons) in Finance and Economics from the Wharton School of the University of Pennsylvania, where he graduated magna cum laude.

Matthew Shafer

Matthew Shafer

International Head of Distribution, Europe & Asia

PGIM Investments

Matt Shafer is head of international distribution for Europe and Asia at PGIM Investments, leading its growth plans in wholesale and retail markets outside the U.S. Based in London, he focuses on broadening and deepening relationships with Global Financial Institutions private banks, independent wealth managers, fund of funds, family offices and other distributors. He also has executive oversight of international distribution strategy.

Prior to joining PGIM Investments, Matt was head of EMEA at BNY Mellon Investment Management. Before that, he was head of international distribution at Natixis Investment Managers. Earlier in his two-decade career, he was head of sales for offshore funds, alternative investments and managed products at Merrill Lynch in the US and subsequently in London.

Matt has a bachelor’s degree in economics from the University of Buffalo.

Frank Shen

Frank Shen

Principal, Head of Greater China, Global Wealth Management Asia Pacific

Apollo Global Management

Frank Shen joined Apollo in 2022 as a Principal of the Global Wealth Management team and is responsible for Greater China coverage. Prior to joining Apollo, Mr. Shen worked at Oaktree Capital since 2019, where he was a vice president of Oaktree’s Greater China marketing team and looked after both institutional and intermediary relations in the region. Prior to that, he worked at HuaAn Funds, one of the first asset managers established in mainland China, where he was an assistant director in Corporate Development. Prior thereto, he was with Mirae Asset Global Investment as a senior manager where he was responsible for business development in mainland China. Mr. Shen began his career with Shanghai Securities, where he served both as a client manager and research analyst. Mr. Shen received a MSc in financial analysis and fund management, as well as a BA in business economics from the University of Exeter, UK. He is a native Mandarin speaker and is also fluent in Cantonese and Shanghainese.

Angelle Siyang-Le

Angelle Siyang-Le

Director

Art Basel Hong Kong

In her role as Director, Art Basel Hong Kong, Angelle Siyang-Le leads the direction of Art Basel’s flagship event in Asia and will drive the Hong Kong show’s future development. Prior to her appointment as the director in November 2022, Siyang-Le oversaw the business development of Art Basel in Greater China, as well as show strategy and gallery relations for the Hong Kong show. In 2020, Siyang-Le led the first Spotlight event by Art Basel in Hong Kong, re-establishing an in-person platform for the art community to exchange ideas during the pandemic. Siyang-Le joined Art Basel in 2012 from The Farook Collection, a private collection in the United Arab Emirates as the Collection Representative. Concurrently, she managed the not-for-profit art space, Traffic and the affiliated artist studio, Satellite in Dubai where she focused her support on galleries, artists, curators and young art professionals. During her time in the Middle East, she also worked as a curator and writer, as well as co-founded The Mobile Art Gallery, an initiative that aims to bring contemporary emerging art to a broader audience. Born in Mainland China, Siyang-Le grew up between Mainland China and the United Kingdom. She holds an M.A. in Modern and Contemporary Art from Christie’s Education and a B.S. in Urban Planning, Design, and Management from The Bartlett, University College London.

Jia Ning Song

Jia Ning Song

Head of Advisory and Head of Banking and Capital Markets Sector - Hong Kong

KPMG China

Ning is the Head of Advisory and Head of Banking and Capital Markets Sector - Hong Kong for KPMG China. He defines and oversees the execution of the firm’s cross sector advisory strategy with a focus on serving top global and Chinese financial services clients, public sector and corporate firms. In this dual capacity role he works extensively with Financial Services and Real Economy clients, regularly interacting with executives and board members, helping them navigate their most pressing business challenges and achieving their most strategic opportunities.

Over the past 17 years, he has been based in Hong Kong China. He has consistently served as a bridge between global and APAC, ensuring alignment and outcomes across his clients’ most urgent and critical projects, including regulatory reform, risk transformation and market entry / expansion initiatives.

Ning is a member of the AICPA, a certified Financial Risk manager, and a dual CFA and CAIA charter-holder. He also holds an Executive MBA from the Columbia University, London Business School and Hong Kong University.

Ning currently serves as an advisor to a NGO promoting environmental protection and sustainability. He previously served as the co-chair of Financial Service Committee for the American Chamber of Commerce. He is an advocate on childhood learning, development and education, and is passionate on the topics of health and well-being and environmental sustainability.

Michael Stanhope

Michael Stanhope

Founder & Chief Executive Officer

Hubbis

Michael is a pivotal figure in Asia's wealth management landscape, establishing Hubbis as a leading platform for industry insights, events, and professional development. With over 30 years in the sector, Michael has fostered a hub where senior professionals from private banks, boutique firms, asset managers, and advisory practices converge to discuss strategic industry trends. Since founding Hubbis over 16 years ago, he has been instrumental in shaping the industry through high-calibre events and extensive editorial content.

Michael's career began in Asia-Pacific in 1993, where he held roles in Hong Kong, Sydney, and Singapore. Starting with Euromoney, he later joined Thomson Financial, launching Finance Asia and specialized publications. In 2002, he founded Pacific Prospect, a media company acquired by Incisive Media, marking his first entrepreneurial success.

Originally from North Wales, Michael was head boy of St David’s College Llandudno and holds a Business Administration degree from Cardiff University. He resides in Asia with his wife Michelle, and has three grown-up children: Reanna, Garett, and Tarryn.

Peter Tung

Peter Tung

Managing Director & Regional Head, Private Banking, Greater China & North Asia

Standard Chartered Bank (Hong Kong) Limited

Peter is a seasoned private banker with over 30 years of experience managing UHNW clients and family offices across Hong Kong and mainland China. He currently leads Standard Chartered’s Greater China Private Bank business and serves on the bank’s Executive Committee for the Global Private Bank, Standard Chartered Hong Kong and Standard Chartered Asia in Hong Kong.

Peter holds a Bachelor degree from the University of California, Berkeley and an MBA in Corporate Finance from Columbia Business School.

Over the course of his career, Peter spent 17 years at Morgan Stanley, where he built and led high-performing teams to expand private wealth management businesses in Taiwan and the Phillipines. During his tenure, he managed UHNW and family office clients, spearheaded strategies across product development, recruitment, risk management and marketing.

In 2011, Peter joined UBS as Head of Greater China for UHNW where he championed the ‘Billionaire’ coverage team. Peter was also a member of the UBS Wealth Management APAC Executive Committee and was an active member in various functional committees.

In 2016, he co-founded Lioncrest Global, a boutique venture investment and advisory firm focused on smart city and real estate investments. He later became Regional Head of Greater China Private Bank and Treasures Private Clients at DBS (HK), before joining Standard Chartered in 2022. He is also actively involved in the industry as an EXCO member for the Private Wealth Management Association (PWMA) in Hong Kong.

Bernard Wai

Bernard Wai

Asia Pacific Head, Family Office Group

Citi Private Bank

Bernie leads the Private Bank’s efforts to address the needs of Asia Pacific clients including regional family offices, private investment companies, and family businesses.

Prior to joining Citi Private Bank, Bernie was Head of Sales at Citi Retail Cross Asset Solutions where he successfully drove the coverage strategy for the group’s intermediaries, and broad retail channels across Asia, including Japan and India. He was also previously Head of Pan-Asian Equity Derivatives and Convertible Bond Sales.

Prior to joining Citi in 2002, Bernie was an equity derivatives salesperson covering US hedge funds at Morgan Stanley in Hong Kong. He is a CFA charterholder and a bachelor’s in economics from the Wharton School of the University of Pennsylvania.

Alex Wong

Alex Wong

Partner

Karas So LLP in Association with Mishcon de Reya

Alex Wong is a Partner of Karas So LLP in Association with Mishcon de Reya. He specialises in commercial litigation and dispute resolution, with a particular emphasis on private wealth matters, including contentious trust and probate, company, tax, shareholder, and joint venture disputes. He also specialises in international arbitration. Alex regularly represents high net worth individuals, institutional, and corporate clients. In 2024, he is recognised by Chambers High Net Worth Guide for Private Wealth Disputes, by Legal 500 in Hong Kong for Dispute Resolution: Litigation and Domestic and International Corporate Tax, and by Who’s Who Legal for Hong Kong Corporate Tax. Alex is a Solicitor Advocate. He is also a member of Chartered Institute of Arbitrators.

Jack Wong

Jack Wong

Digital Wealth Solutions Lead, North Asia

LSEG Data & Analytics

Jack Wong is the Digital Wealth Solutions Lead for North Asia at LSEG Data & Analytics, bringing over 29 years of extensive experience in financial services and digital solutions. For the past decade, he has successfully delivered a range of digital solutions, including database projects, portals, and mobile applications, to top-tier financial institutions across the Asia Pacific region.

With a strong foundation in solution architecture, Jack excels in all aspects of the implementation process—from solution design and database management to project management and user adoption. His comprehensive expertise ensures that the digital solutions he develops not only meet client needs but also drive significant business value.

Jack holds a Bachelor of Economics and is a certified HK Stock Dealer's representative. He has completed AMS Training and possesses a Securities and Futures Commission Type 4 license, underscoring his commitment to professional excellence in the financial sector.

Having been with LSEG for 10 years, where he continues to lead innovative projects that enhance digital wealth management solutions in the region. His dedication to advancing financial technology positions him as a key player in shaping the future of digital finance in North Asia.

Dr. Andy Xie

Dr. Andy Xie

Independent Economist

Dr. Andy Xie is Shanghai-based independent economist specializing in China and Asia. He is also a guest columnist for the South China Morning Post.

Dr. Xie is one of the few economists who has accurately predicted economic bubbles including the 1997 Asian Financial Crisis and the more recent subprime meltdown in the United States. He joined Morgan Stanley in 1997 and was Managing Director and Head of the firm’s Asia/Pacific economics team until 2006. Prior to that he spent two years with Macquarie Bank in Singapore, where he was an associate director in corporate finance. He also spent five years as an economist with the World Bank.

He was voted one of the 50 most influential persons in finance by Bloomberg Magazine in 2013. He was voted by institutional investors as the best economist in Asia Pacific between 2000-06 in Institutional Investors poll. The CCTV and the WEF voted him one of the ten future leaders in China in 2001.

Dr. Xie earned a Ph.D. in Economics in 1990 and an M.S. in civil engineering in 1987 from the Massachusetts Institute of Technology.

Sueann Yeo

Sueann Yeo

Head of APAC Private Wealth

EQT Partners

Sueann Yeo joined EQT’s Private Wealth Client Relations and Capital Raising team as the Head of APAC Private Wealth in 2022, based in Singapore. Prior to joining EQT Partners, Sueann was an Executive Director and Head of Alternative Investments (Southeast Asia) at J.P. Morgan Private Bank. Sueann received a BBM with a major in Finance from Singapore Management University. She is also a Chartered Alternative Investment Analyst (CAIA) charter holder.

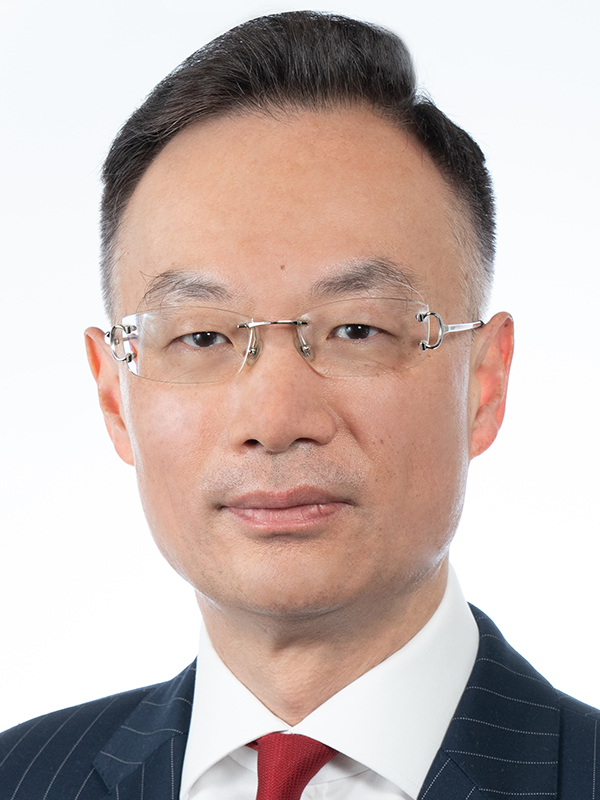

Dr. Eric Yip

Dr. Eric Yip

Executive Director, Intermediaries

Securities and Futures Commission

Dr. Eric Yip is a member of the Securities and Futures Commission (SFC). He is also an Executive Director heading the Intermediaries Division, which comprises the Intermediaries Supervision and Licensing departments. The Division is primarily responsible for administering licensing requirements and conducting ongoing supervision of licensed corporations with a focus on their business conduct and financial soundness.

Dr. Yip is a seasoned financial professional having in-depth knowledge of the operation and regulation of the financial markets in Hong Kong and Mainland China. Prior to joining the SFC, he held senior roles in banking, asset management and Hong Kong Exchanges and Clearing Limited. He began his career as a Management Consultant at McKinsey and Company.

Dr. Yip sits on the SFC’s Executive Committee.

Wilfred Yiu

Wilfred Yiu

Deputy Chief Executive Officer

Hong Kong Exchanges and Clearing Limited (HKEX)

Wilfred Yiu was appointed Deputy Chief Executive Officer of Hong Kong Exchanges and Clearing Limited on 1 March 2024.

In addition to this role, Mr Yiu acts as Co-Chief Operating Officer and Co-Head of Markets, with oversight of HKEX’s Markets and IT divisions. He is also Chief Executive of HKEX’s wholly-owned subsidiaries, The Stock Exchange of Hong Kong Limited and Hong Kong Futures Exchange Limited.

Mr Yiu joined HKEX in 2019 as Head of Markets and was named Co-Chief Operating Officer in 2023. Since joining the Group, he has played a leading role in strengthening HKEX’s market infrastructure and diversifying its product and service ecosystem. He oversaw the launch of major initiatives including significant expansion to the Connect Programme, enhancement of Hong Kong’s role as Asia’s ETF marketplace, the rollout of Severe Weather Trading arrangements for Hong Kong market, HKD-RMB Dual Counter Model and Derivatives Holiday Trading, providing investors with greater opportunities and wider cross-border market accessibility.

Mr Yiu has nearly 30 years of experience in international capital markets and has worked at global banks in the US, Mainland China, and Hong Kong. Prior to joining HKEX, he had a 20-year career with Goldman Sachs, where he was last Deputy Chief Executive Officer and Chief Operating Officer at Beijing Gao Hua Securities Company, a joint venture of Goldman Sachs in Mainland China, and was responsible for the company’s China sales and trading businesses. Previously, Mr Yiu was Head of Credit Structured Products for Asia at Goldman Sachs in Hong Kong.

Margaret Zhao

Margaret Zhao

Managing Partner

HT Family Office

HT Family Office, is a single-family office based in Beijing, Hong Kong and Singapore covers a full spectrum of investment activities and strategic portfolio management in various sectors including healthcare, TMT industry, and deep technology. HT family office interests and activities include various different stages of investments i.e. early and late-stage VC, PE, FOF, and the public markets. Our investment portfolios are global with key partners Primarily in the US and China. https://htcapital.net/

Margaret Zhao received her bachelor’s degree in Biochemistry from University College London and her Master of Drug discovery and development from Imperial College London.

More speakers to be announced soon.